Inflation has been our number one discussion point during the past few months and for good reason. The most recent data shows the highest rate of inflation in 30 years by some measures. Due to its unexpected and massive rise, inflation is a near daily headline in both the financial press and the evening news, but we don’t need the news to tell us this information. We experience it every day from the gas pump to the dinner plate and it’s worrisome because we don’t know how bad it is going to get or how long it will last.

Not to worry though… the economists at the Federal Reserve tell us that our high inflation rate is “transitory.” Never mind that this very group has been surprised by every inflation reading this year. Never mind also that they are the ones printing trillions of new dollars. No conflict of interest to see here…

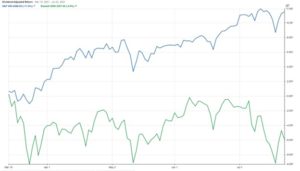

Even as inflation is making life more difficult for the average American, the S&P 500 seems unphased as it continues to hit new highs. However, the Russell 2000 small cap index hasn’t been as resilient in the face of high inflation. Small companies typically cannot adjust as quickly to rising prices as large companies, and they don’t have the capital resources to weather inflation like their big brothers in the S&P 500. Since the Russell 2000’s most recent high on March 15 of this year, it is down almost 6% while the S&P 500 is up 11.5% as of July 21. As long as inflation is running hot, we believe large cap stocks will have an advantage over the more inflation sensitive small cap stocks.

(Chart Source: StockRover.com)

Our examination of the recent performance of U.S. Large Cap stocks has shown us some emerging weakness. One of the most glaring weaknesses is that fewer stocks are participating in the new highs of the S&P 500. If this negative divergence doesn’t improve quickly, it will greatly increase the odds of a correction. And, in looking at the data, a correction may be just around the corner.

Two things we have in abundance at Trademark Capital are grey hair and market experience. We’ve been through many forms of economic expansions and contractions. During challenging economic environments, our primary goal is to have your money in positions where we believe it will be treated best. As the markets transition into their next phase, we will monitor risk and how this risk could potentially affect your portfolio, making changes when appropriate.

If you have concerns, please reach out to us. We always love to hear from you.

This material is intended for informational purposes only and should not be construed as legal, accounting, tax, investment, or other professional advice. Trademark Capital’s investment strategies are built using quantitative, proprietary algorithms that are designed to identify and react to changing market conditions. However, investors should be aware that no investment strategy or risk management technique can guarantee returns or eliminate risk in any given market environment. As with all investments, Trademark Capital Management’s investment strategies are subject to risk and may lose money. The investment strategies presented are not appropriate for every investor and individual clients should review with their financial advisors the terms and conditions and risk involved with specific products or services. Due to our active risk management, our managed portfolios may underperform during bull markets. Past performance is no guarantee of future results.