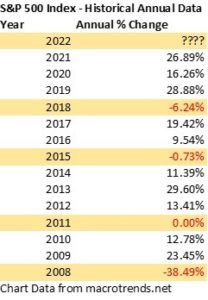

There’s no question the market has had a great run. The S&P 500 achieved a nearly 27% gain in 2021—and that after double-digit returns the prior two years.

However, that level of annual return can’t continue forever. We’ve had a lot of conversations recently about managing expectations about market performance in 2022. I would like to share the below table, which shows the ups and downs of the S&P 500 dating back to 1926 (if you follow the link). The key takeaway is this: While no one can say for sure what 2022 will hold, after three record-strong years, it’s good to remember not every year will be a “20 percenter.”

Inflation ‘Transitory’ No More

In early December, you may have seen the news that Federal Reserve Chairman Jerome Powell and Treasury Secretary Janet Yellen said it’s time to retire the term “transitory” when discussing inflation. The chairman added in late 2021 that while it’s difficult to predict how long the effects of supply chain issues will linger, “factors pushing inflation upward will linger well into next year.” Not exactly the news any of us wanted to hear as we approached a new year.

In 2022 the economy is expected to continue growing but at a slower pace. Consumer sentiment is down, yet consumer spending remains at a solid pace. Supply chain issues with high demand have helped stoke the inflation fires as the Fed has announced that they plan to raise rates 3 times in 2022. This seems to be a prudent course of action as inflation is at its highest in 40 years. So where do we go from here? To the past to see how we have tackled inflation before and hope that it will allow us to peer into the crystal ball for a clearer way forward. This current spike in inflation has lasted longer than most expected, and most economists hope it to be short lived given the US’s most active monetary policy since the 80s. In the past we have seen that higher inflation has led to weaker markets and slower economic gains.

![]()

Are we in the midst of setting up for a taper tantrum as the Fed continues to scale back its bond purchases? If so, what does that mean for your portfolio?

What to Expect from the Federal Reserve in 2022

In mid-December, the Federal Reserve announced it is speeding up its tapering operation and expects to conclude the taper by March 2022 instead of June 2022. The faster taper also sets the stage for rate increases. The Fed has forecast three rate hikes in 2022, and Goldman Sachs is now predicting four rate hikes. However, the potential for Omicron or other future variants to derail the Fed’s plan does exist.

This material is intended for informational purposes only and should not be construed as legal, accounting, tax, investment, or other professional advice. Trademark Capital’s investment strategies are built using quantitative, proprietary algorithms that are designed to identify and react to changing market conditions. However, investors should be aware that no investment strategy or risk management technique can guarantee returns or eliminate risk in any given market environment. As with all investments, Trademark Capital Management’s investment strategies are subject to risk and may lose money. The investment strategies presented are not appropriate for every investor and individual clients should review with their financial advisors the terms and conditions and risk involved with specific products or services. Due to our active risk management, our managed portfolios may underperform during bull markets. Past performance is no guarantee of future results.